cheapest refinance rates explained for beginners

What “cheap” really means

The lowest rate isn’t always the best deal. Look at the APR, which blends interest with lender fees, discount points, and closing costs. A tiny rate paired with big fees can cost more than a slightly higher rate with minimal charges, especially if you won’t keep the loan long.

How to find and evaluate offers

Start by improving credit, trimming debt, and verifying your home’s equity. Then collect quotes on the same day and with the same term, loan type, and points so you can compare apples to apples. Ask for a written Loan Estimate, check the break‑even timeline, and consider whether to lock or float based on your timeline and risk tolerance.

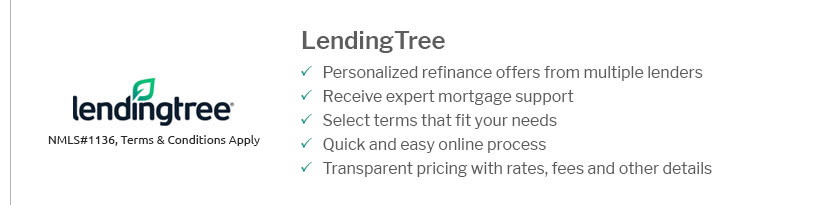

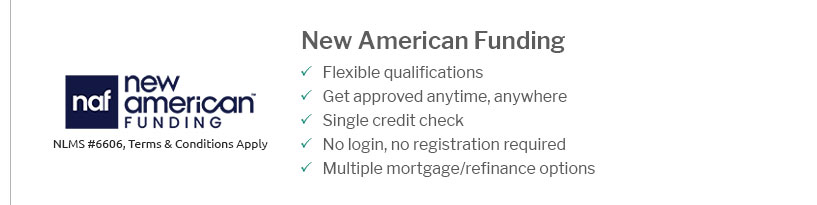

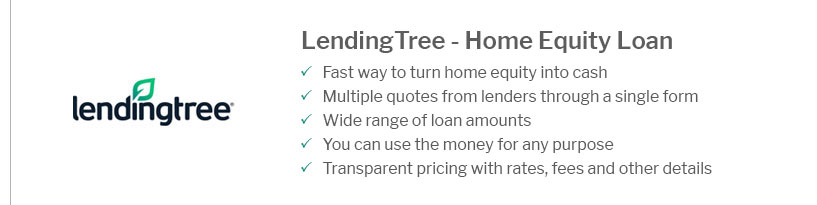

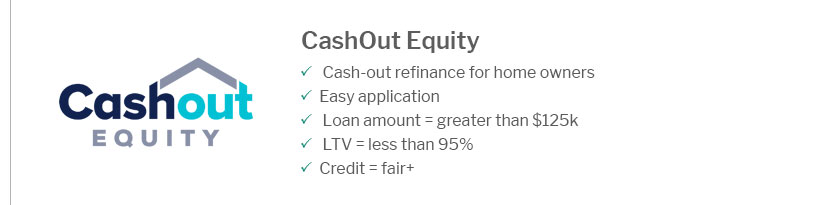

- Shop at least three lenders including a credit union or online lender.

- Match terms: 15 vs 30 years changes costs dramatically.

- Watch fees: underwriting, origination, and third‑party costs.

- Mind prepaids like taxes and insurance; they aren’t lender profit.

- Recalculate total interest if you restart the clock.

Finally, remember that the cheapest refinance rates usually go to well‑qualified borrowers, but a clear, consistent comparison can still uncover savings.